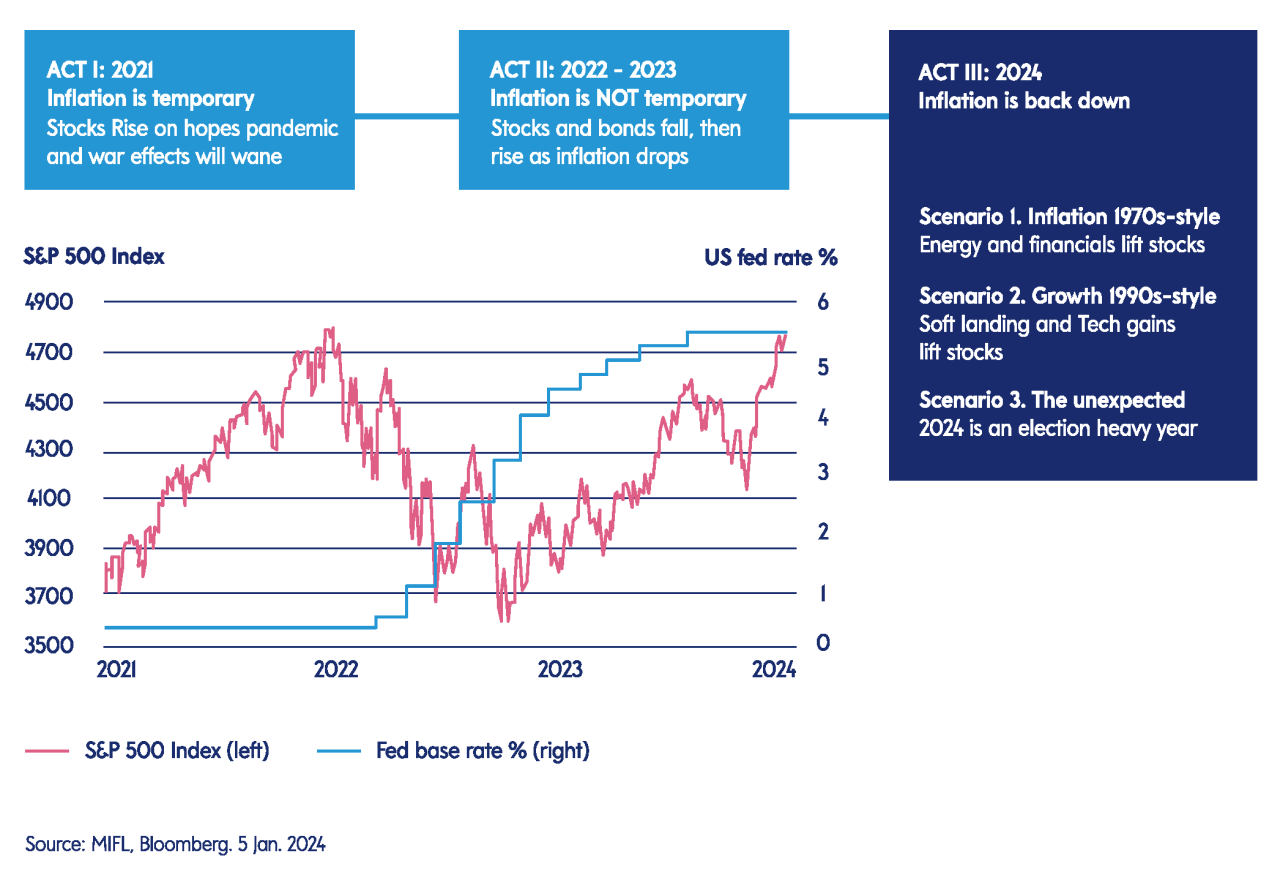

In 2024, the financial stage is set for the conclusive third act of the inflation shock saga that began in 2020. The macro-economic landscape has been shaped by events like the pandemic, the geopolitical conflicts, and now inflation is influencing pivotal fiscal and monetary decisions.

MIFL Global Market Outlook - 2024 Q1

- Key Insights

- Bonds

- Equity

2024: The Final Act of an Inflation Story?

While acknowledging the delicate balance central banks are facing, caution is urged even though market expectations indicate possible rate cuts in 2024.

Markets expect six rate cuts in Europe and the US - too optimistic?

Impacts on major asset classes are nuanced. Bonds, especially in Europe and the UK, stand to benefit from potential rate cuts, while emerging markets present opportunities. Equities retain strong earnings, but valuations are modestly expensive. Active management gains prominence amid potential challenges, and the Technology sector's trajectory becomes crucial. In this dynamic environment, diversification emerges as a potent risk mitigation tool.

For income-focused investors, stability is found in dividend aristocrats and fixed income coupons among evolving market conditions. As we stand on the precipice of 2024, your strategic choices become pivotal in shaping the conclusive narrative of the inflation story.

What you will learn:

Market expectations: navigate through anticipated market shifts and potential rate cuts in 2024.

Asset class impact: learn how bonds, equities, and emerging markets respond to the evolving economic scenario.

Diversification strategies: uncover the power of diversification as a reliable risk mitigation tool.

Welcome to Bonds 2024: Navigating Change

After two years of rising yields, 2024 offers partial relief with a global slowdown and lower inflation, particularly benefiting safer segments like developed sovereign bonds. While Europe and the UK anticipate yield retreats, the U.S. charts a unique path with robust growth and a higher budget deficit.

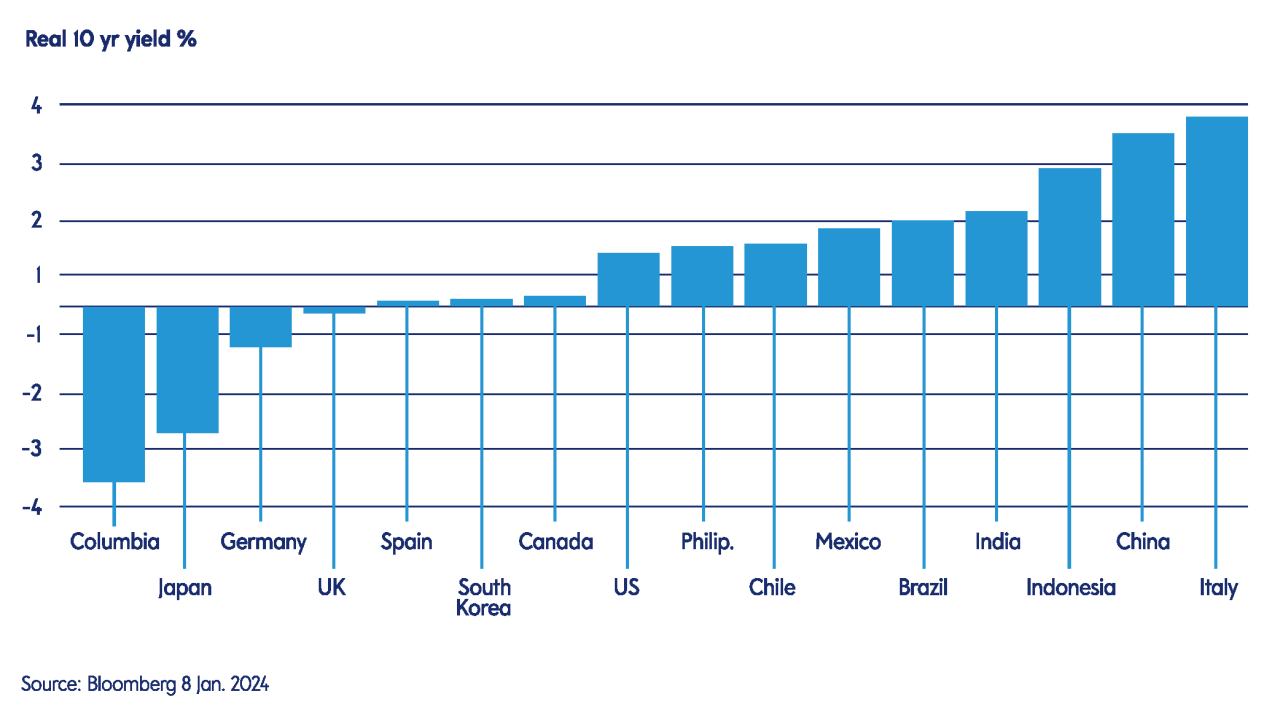

Solid inflation homework lifts Emerging Markets' Real Yields

The European Central Bank (ECB) is expected to make decisive rate cuts in response to economic challenges, creating a favourable environment for European sovereign bonds. Meanwhile, the U.S. may deviate due to distinct macro-economic conditions.

Our report provides a comprehensive guide to navigating the intricate bond landscape of 2024.

For detailed insights and a roadmap to navigate the bond market in 2024, explore our full financial report

What you will learn:

Bond relief: explore our full report for a deep dive into how 2024's slowing growth and falling inflation could bring relief to developed sovereign bonds.

Yield Curve Dynamics: understand the nuances of yield curves in Europe and the US, predicting potential impacts of rate cuts and unique macro influences.

Global Outlook: navigate the global landscape with our report, highlighting opportunities in European and UK fixed income assets, strategic insights into Emerging Market debt, and a cautious approach to Corporate bonds amid a defensive stance.

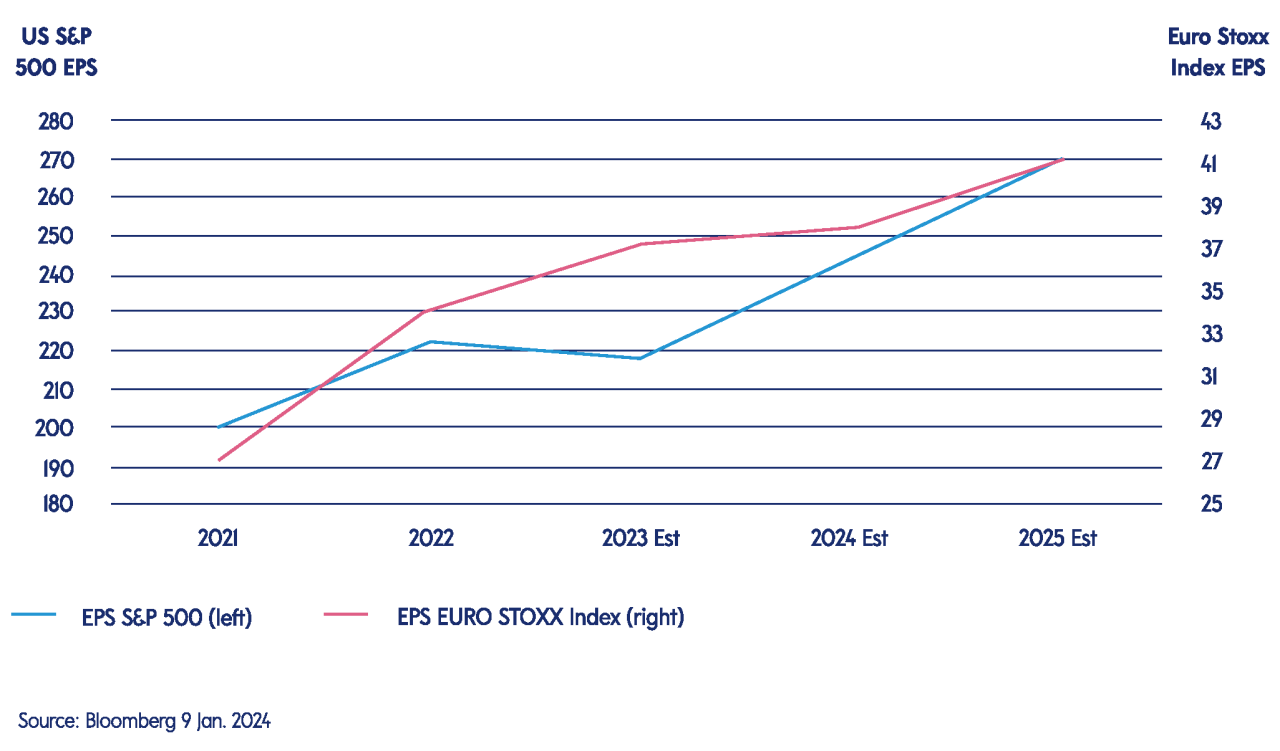

Equities: earnings expected to stay strong despite slower growth

Projections indicate robust earnings per share (EPS) growth above 10%. Despite the strong 2023 returns, 2024 may pose a number of challenges. With global equity valuations reaching 15.9 times earnings, EPS is primarily driven by elevated valuations in US technology stocks, particularly in AI.

Strong earnings forecasts may continue to support Equity markets

2024 has been defined as the “year of active management”, a more tempered Equity rally is expected due to slower growth and increased valuations. However, the potential for an Equity upswing persists if a global recession is averted, buoyed by resilient consumer behaviour and growth in sectors like Technology and Healthcare.

The pivotal question for the year revolves around investor sentiment toward Technology and AI—Tech fatigue or triumph? While we endorse Technology as a long-term trend, a short-term revaluation may occur if a 2024 recession prompts a shift towards defensive sectors.

For a deeper dive into these insights and more, explore our Global Market Report—a strategic compass for navigating the nuanced Equity landscape.

What you will learn:

Earnings Strength: explore 2024 challenges and the impact of global equity valuations at 15.9 times earnings, led by US Tech.

Active Management Year: understand how resilient consumers and growth sectors sustain gains amidst global economic uncertainties.

Tech Dynamics: find out how Technology may re-rate during a recession, leading to interest in defensive sectors.

China's Impact: Deep dive on the reasons for China's economic reboot and its influence on global equities.

Quality Bias: step into the late economic cycle and focus on quality stocks with robust pricing power.